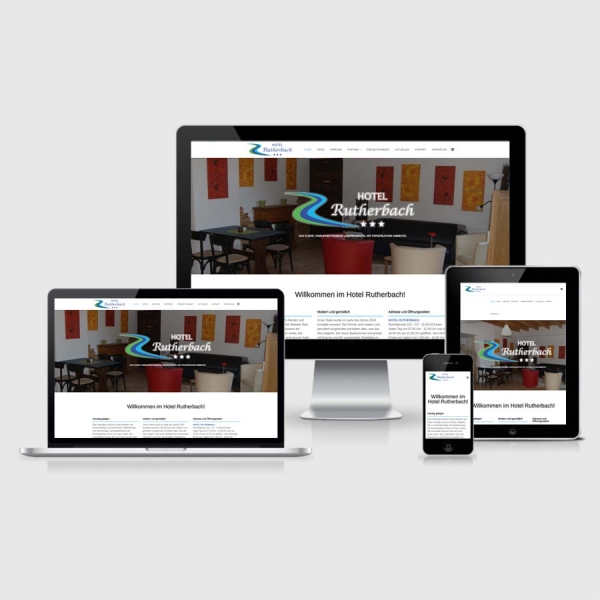

After the change of the operator, the Hotel Rutherbach now presents itself with an updated website

The new version of the hotel's website also took into account the current functionality and display requirements for different devices. This way, the website can be displayed optimally in a smartphone, tablet, laptop or on a desktop PC.